Agrochemicals Market Intelligence

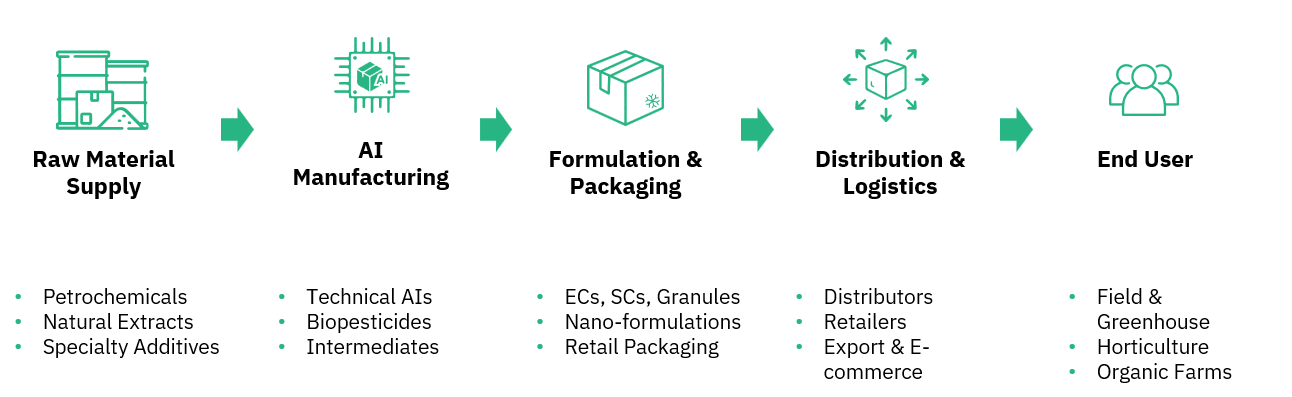

Sustaining the world's growing population despite climate change, natural resource limitations, and pest resistance is a daunting challenge. Agrochemicals—pesticides, herbicides, fungicides, biostimulants, and soil conditioners—are leading the world renaissance of agriculture. From precision spraying to bio-based innovation, agrochemicals today are intelligent, sustainable, and data-driven.

The agrochemicals sector is evolving rapidly because of:

-

Growing need for higher crop output with diminishing arable land

-

Increasing demand for less toxic and bio based products

-

More regulatory push and drive towards residue-free production

-

Growing in precision agriculture and drone-powered application technology

-

Climate-change-enabled pest migration and disease transmission

Certain problems, however, still stand:

-

R&D and regulatory clearances are expensive

-

New pesticide resistance in weeds and new pests

-

Raw material volatility and trade disturbances

-

Satisfying performance requirements and sustainability expectations

How we help?

We track historical yield and acreage trends. Our research deploys forthcoming crop protection trends, market movement, formulation innovation, and regulatory directions regionally.

We assist customers:

-

Monitor country-level active ingredient registration pipelines

-

Insights into adoption trends of bio-pesticides and biostimulants

-

Monitor price direction for technical-grade inputs and ingredients

-

Benchmark trend usage by crop, region, and pest profile

-

Resistance management strategy gaps