Veterinary Medicine Market Intelligence

Where Animal Health Meets Market Intelligence!

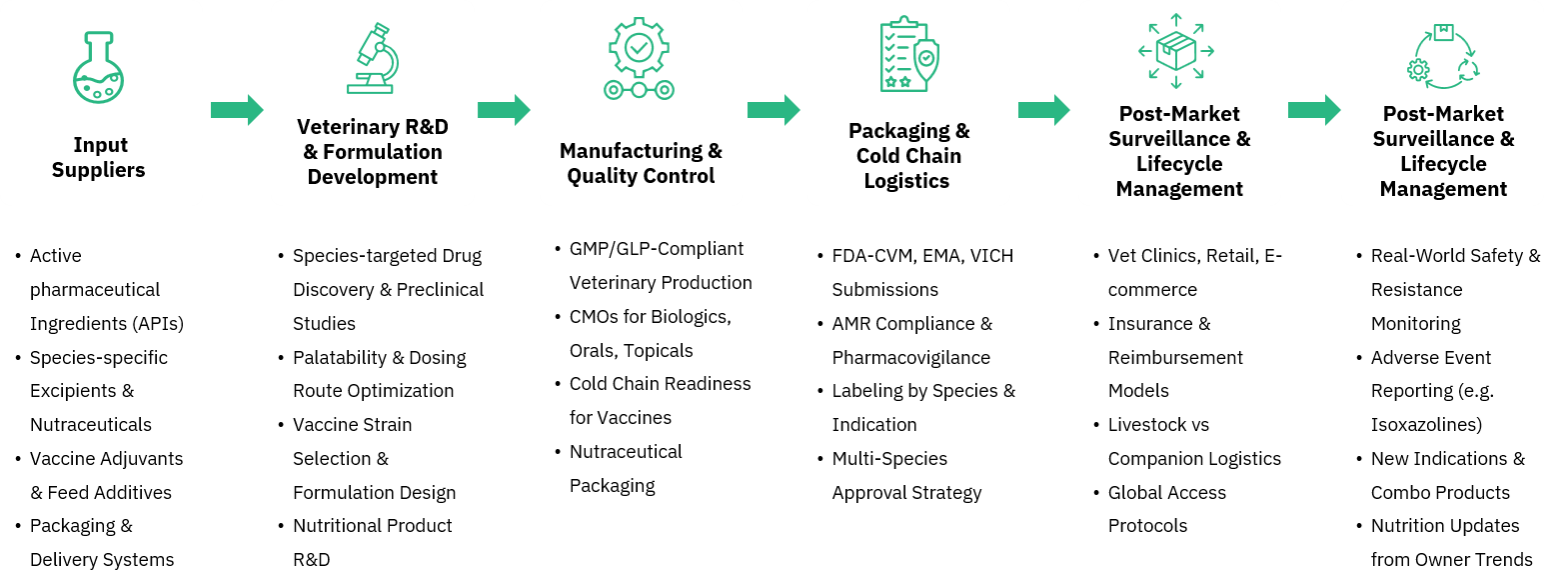

Welcome to the veterinary medicine cluster; your strategic lens into one of the fastest evolving segments in global life sciences. Covering companion animal therapeutics, anti-infectives, vaccines, isoxazoline drugs, and nutritional innovations, this cluster is designed for those shaping the future of veterinary health.

As pet ownership surges, zoonotic threats increase, and precision veterinary care gains traction, understanding these intersecting dynamics is more crucial than ever. Whether you're tracking flea resistance trends, scaling nutritional innovations for geriatric pets, or navigating VICH regulatory updates, this cluster connects real time insights with actionable strategy.

Why This Cluster Matters Now:

-

Companion animal spending is exploding with veterinary products and services.

-

Veterinary vaccines are entering a golden age: DNA based and recombinant vaccines are revolutionizing prevention models.

-

Nutrition is becoming personalized: Geriatric formulations, microbiome enhanced feeds, and breed specific diets are gaining clinical and retail traction.

-

Antimicrobial resistance in animals is a global concern: Regulatory push toward stewardship is reshaping anti infective portfolios.

How We Help: Turning Veterinary Complexity Into Strategic Clarity

In a field where clinical nuance meets consumer expectation, our veterinary medicine cluster bridges data with direction. We equip animal health strategists, regulatory leaders, R&D innovators, and commercial decision makers with the intelligence needed to win in a market defined by therapeutic acceleration, compliance complexity, and strategic investment.

Whether you're planning a flea/tick lifecycle extension, scouting partnerships for microbiome based feeds, or navigating VICH guidelines for a novel vaccine, we simplify decision making through:

- Integrated Intelligence: Linking clinical, regulatory, and commercial trends into a unified, easy to navigate framework.

- Signal Over Noise: We don’t just track pet trends, we distill the data that drives market moving behavior and formulary evolution.

- Time to Action: Real world KOL interviews, AMR alerts, and pet owner trends, all delivered fast enough to inform pipeline prioritization and portfolio shifts.

Our goal is simple: to help you act smarter, launch stronger, and lead where veterinary science is heading, not where it’s been!