Laboratory Equipment and Reagents Market Intelligence

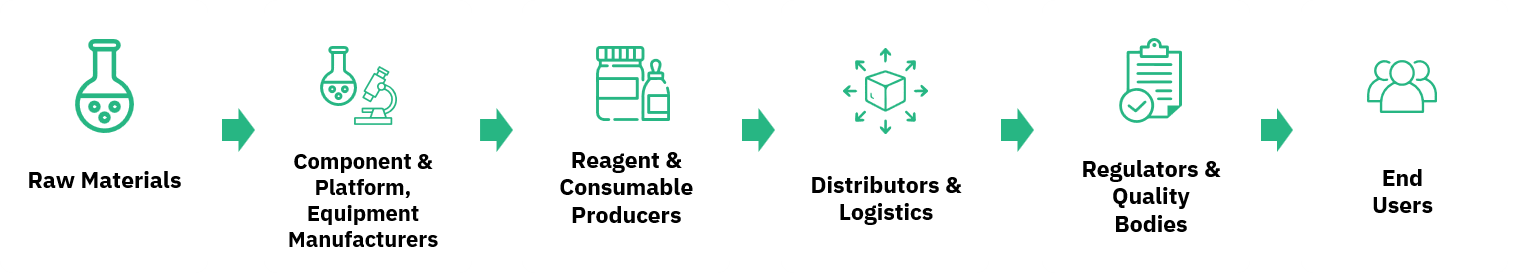

Laboratory equipment & reagents are the lifeblood of life sciences discovery and diagnostics, powering research breakthroughs, enabling translational medicine, and accelerating clinical innovation worldwide.

From advanced NGS platforms mapping the human genome in record time, to mass spectrometry driving precision proteomics, and lab automation reshaping how science is performed, this cluster lies at the intersection of biology, chemistry, data, and automation.

Global demand continues to rise, fueled by:

-

The explosion of genomics & proteomics research

-

Expanding precision medicine and targeted therapy pipelines

-

Growing adoption of lab automation and digital workflows

-

Increased focus on biosecurity and environmental testing

-

Rising investment in academic, clinical, and CRO labs

-

Regulatory shifts driving standardization and quality assurance across industries

At the same time, companies face challenges with, keeping pace with rapid technology turnover and innovation cycles, navigating fragmented procurement ecosystems across geographies, managing complex reagent and consumable supply chains etc. This is where we come in, helping clients cut through the noise, uncover where real demand is shifting, anticipate market turns before they hit, and fine tune strategies that outpace the competition.

We go far beyond simple market sizing, delivering insights that help our clients:

- Decode adoption curves and demand hotspots

- Identify untapped white spaces and unmet needs

- Track funding and procurement cycles across key end-markets

- Anticipate shifts in regulatory requirements and quality standards

- Benchmark against competitors and disruptive innovators

Our intelligence empowers clients to prioritize high growth product categories, track demand side dynamics across academic, clinical, pharma, and CRO settings and benchmark emerging competitors and act decisively in markets driven by science, automation, and data!