Non-clinical and IT Services Outsourcing Market Intelligence

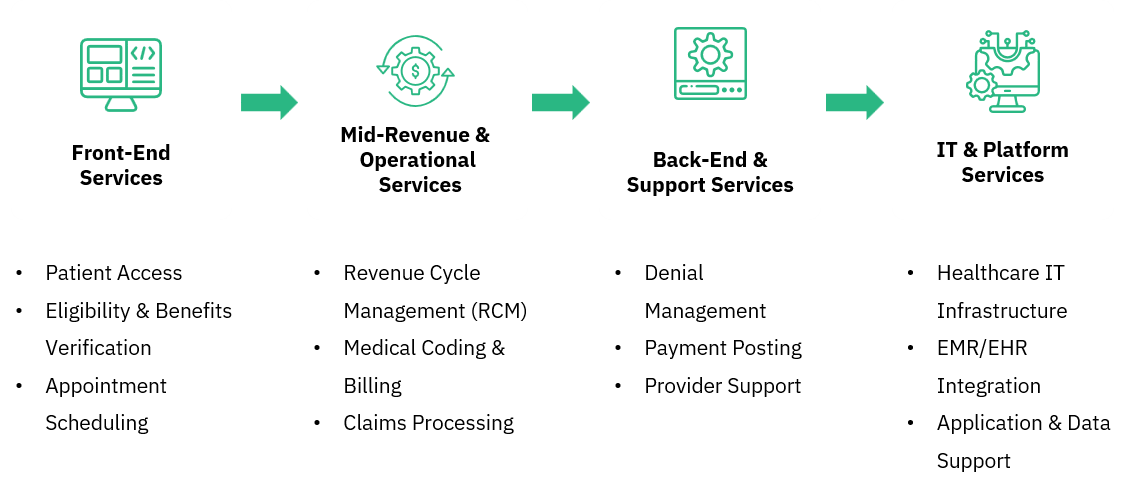

Non-clinical and IT services outsourcing have become the operational backbone of healthcare efficiency, powering hospitals, clinics, and healthcare systems to streamline processes, reduce costs, enhance patient experiences, and ensure regulatory compliance. This cluster intersects technology, administrative innovation, and strategic business processes, reshaping healthcare operations from backend processes to frontline care interactions.

Global demand continues to rise, fueled by:

-

Escalating healthcare expenditure driving cost containment initiatives.

-

Regulatory complexity pushing healthcare providers towards specialized compliance support.

-

Growing digitization of healthcare workflows for enhanced efficiency and interoperability.

-

Increasing need for sophisticated analytics and data driven decision making.

-

Rising focus on patient satisfaction and quality metrics driving refined administrative processes.

-

Expansion of telehealth and remote patient monitoring infrastructure.

Healthcare providers today face challenges in maintaining operational agility, ensuring compliance, managing fragmented revenue cycles, and keeping up with rapid technological evolution. This is where our intelligence provides clarity, helping clients identify critical operational trends, anticipate compliance shifts, optimize outsourcing partnerships, and strategically position themselves for future growth.

Our insights empower clients to:

- Decode outsourcing adoption curves and identify high demand services.

- Uncover unmet needs and untapped potential in healthcare administrative services.

- Monitor regulatory trends and anticipate compliance requirements.

- Benchmark operational efficiency against leading healthcare outsourcing providers.

- Track procurement cycles across hospitals, clinics, and payer organizations.