Petrochemicals Market Intelligence

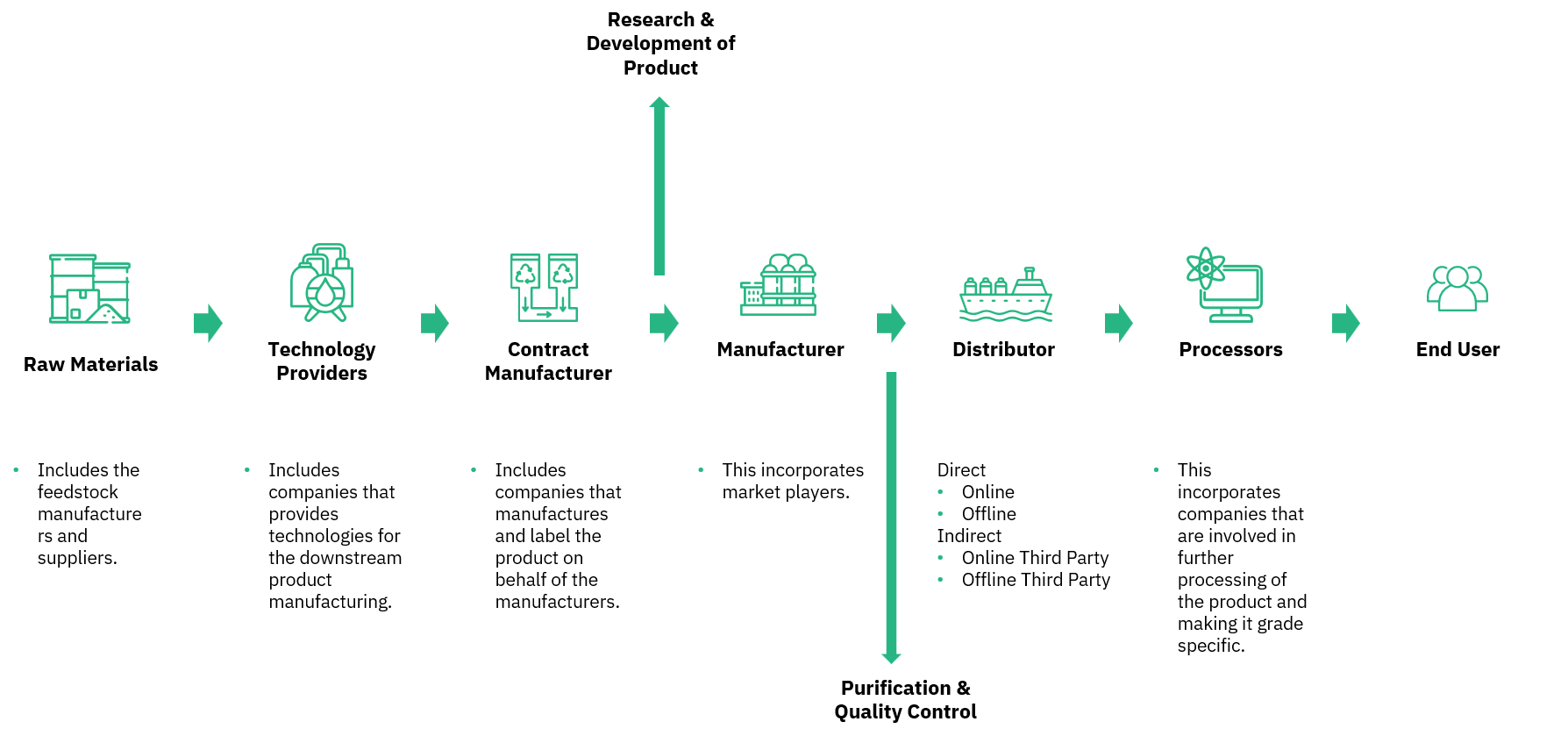

Petrochemicals, regarded as the foundational market for numerous downstream products, play a crucial role in both specialty and bulk chemicals. The industry requires regular monitoring to facilitate effective and informed business decisions. First IQ offers timely tracking and insights within the petrochemical sector, enabling all participants in the value chain to make informed decisions and stay updated on market developments.

Global demand continues to rise, fueled by:

Shifting inclination towards bio-based and sustainable petrochemical products including bio-methanol and bio-ethylene for their use in green technology and products like bio-diesel

Increasing demand for polyethylene (plastics) and PVCs in key end-use industries

Rapidly developing chemicals and chemical intermediate industries, like formaldehyde

Market giants with a global geographical presence supporting and catering to the market demand for petrochemicals from different end-use industries

The decent growth in synthetic fibers, detergents, fertilizers, and various components in electronics, construction, and the automotive industry further drives the global petrochemical market demand

The market is currently facing complexities due to the volatility of petrochemical prices and the downstream products that rely on them as feedstock or raw materials. Additionally, stringent regulations on polyethylene, polyvinyl, and various other petrochemical products—driven by rising GHG emissions and high carbon credit costs—pose further challenges. However, insights provided by First IQ regarding regulatory awareness and initiatives taken by market leaders to address these issues, including operational challenges and concerns about supply chain disruptions, will help both small and large players gain a competitive edge in the industry.

How we help?

We go beyond basic market sizing, delivering insights that help our clients decode adoption trends, uncover white spaces, anticipate regulatory shifts, and fine-tune their go-to-market strategies across the petrochemicals value chain. Our intelligence empowers clients to:

- Prioritize high-growth segments

- Track demand-side shifts across care settings

- Benchmark emerging competitors

- Navigate value-based care trends

- Act decisively in a market shaped by innovation