Drug Development Market Intelligence

Accelerating Tomorrow’s Therapies: From Molecule to Market

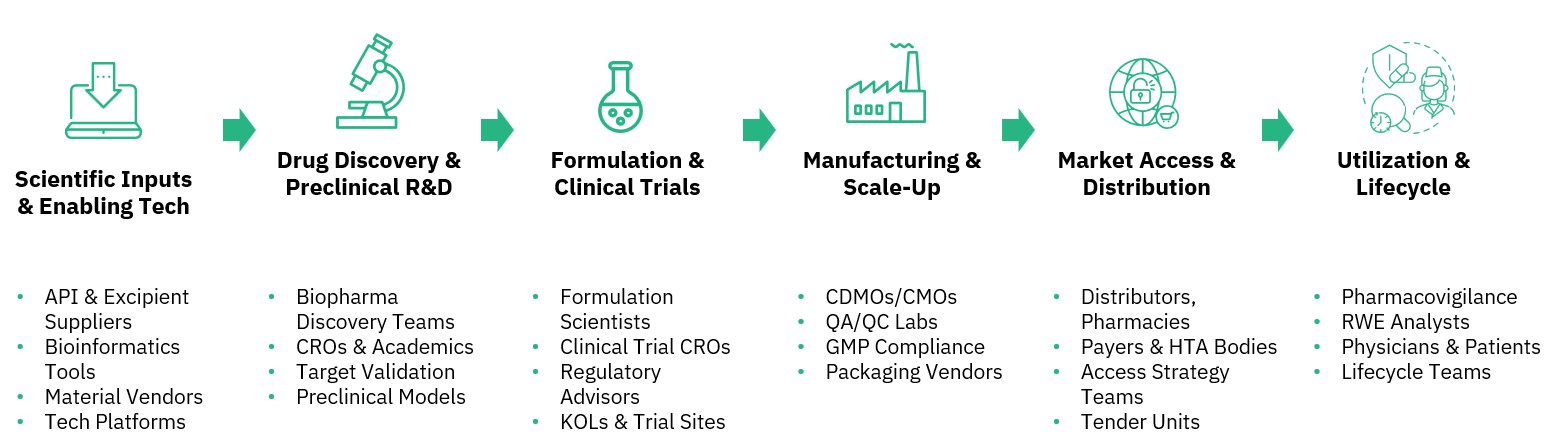

Welcome to the Drug Development Cluster; your gateway to decoding the most dynamic, high stakes frontier of modern healthcare. Here, we spotlight the full journey of therapeutic innovation, from early molecule discovery and formulation design, to smart drug delivery systems and commercial launch.

Whether you're designing life changing oncology drugs, optimizing oral solid dosage for global scale, or pioneering lipid nanoparticle delivery for genetic medicines; our Drug Development cluster empowers you with the 360° insight you need to act faster, smarter, and more boldly!

Why This Cluster Matters Now More Than Ever:

-

Chronic disease prevalence is exploding: New therapies must scale fast

-

Precision medicine is redefining formulation and delivery expectations

-

Complex molecules are pushing the boundaries of traditional R&D cycles

-

Regulatory fast tracks are creating opportunities for first to market advantage

-

Decentralized trials and digital biomarkers are reshaping development strategies

How We Help: From Data to Decisions:

Our platform is built for R&D leaders, regulatory strategists, CDMO scouts, corporate development teams, and investment analysts who need more than headlines; they need clear signals, not noise!