Therapeutic Devices Market Intelligence

Therapeutic Devices are at the forefront of shaping modern healthcare, transforming clinical outcomes, enabling minimally invasive care, and enhancing quality of life for patients worldwide.

From next generation cardiac rhythm management devices restoring life to neurostimulation implants that address previously untreatable neurological disorders, to robotics and AI-enabled surgical precision, today’s therapeutic devices are at the convergence of biomedical innovation, digital intelligence, and precision engineering.

Global demand continues to rise, fueled by:

An aging population with growing chronic disease prevalence

Demand for minimally invasive solutions and faster recovery times

Shifting patient preferences toward outpatient and home-based care

The integration of AI, IoT, and wearable technologies

Regulatory momentum supporting innovation

However, the market faces complexities from navigating price pressures and evolving reimbursement frameworks to staying ahead in fast moving innovation cycles and overcoming interoperability hurdles.

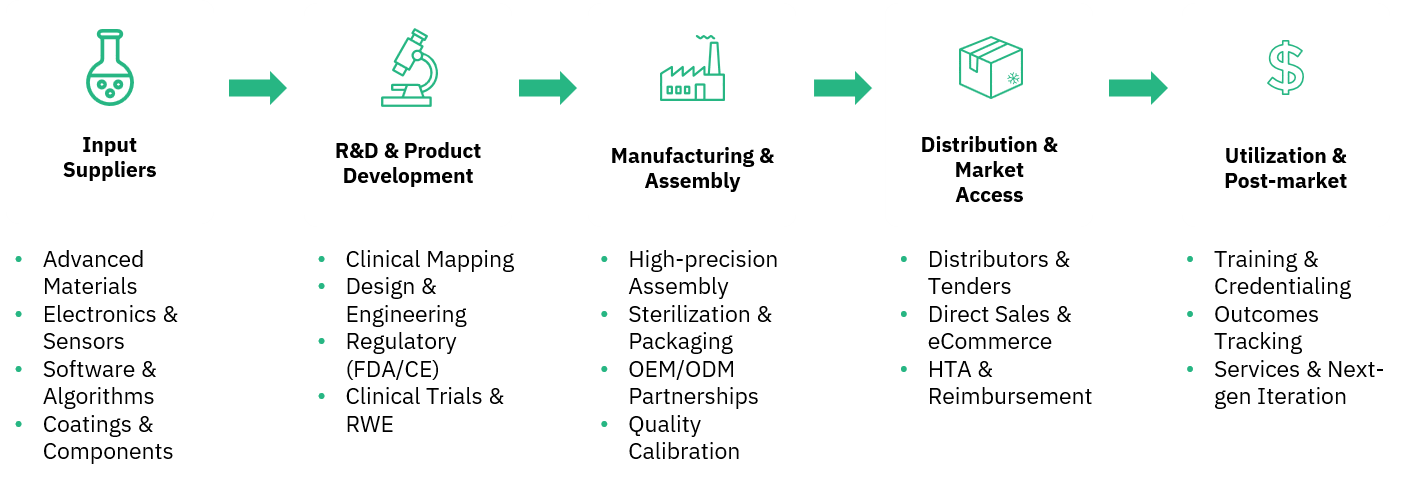

How we help: We go beyond basic market sizing, delivering insights that help our clients decode adoption trends, uncover white spaces, anticipate regulatory shifts, and fine tune their go-to-market strategies across the therapeutic devices value chain. Our intelligence empowers clients to:

- Prioritize high growth segments

- Track demand side shifts across care settings

- Benchmark emerging competitors

- Navigate value-based care trends

- Act decisively in a market shaped by innovation