Biopharmaceuticals Market Intelligence

The significance of biopharmaceuticals in today’s world is immense! These products have transformed the treatment landscape for several previously untreatable ailments such as autoimmune disorders, rare genetic diseases, cancer and infectious outbreaks. They now account a major portion of share in the holistic pharmaceutical sales, and the number is continuously rising. World’s top selling therapies such as adalimumab, pembrolizumab, and new mRNA vaccines are all biopharmaceuticals.

But what makes this space especially challenging and exciting right now is its rapid diversification. It is no longer just about blockbuster biologics but the next wave of biopharmaceuticals is driven by:

-

mRNA 2.0 platforms entering oncology

-

Biosimilar wars heating up in the U.S. post-Humira loss of exclusivity

-

Off the shelf CAR-T therapies approaching commercial reality

-

Cell and gene therapy QC, which is quietly becoming the next billion-dollar niche

-

AI in biopharmaceutical design, slashing discovery timeframe from years to months

At the same time, developers are grappling with scale up inefficiencies, price sensitivity, and growing complex regulatory pathways. That’s where we come in!

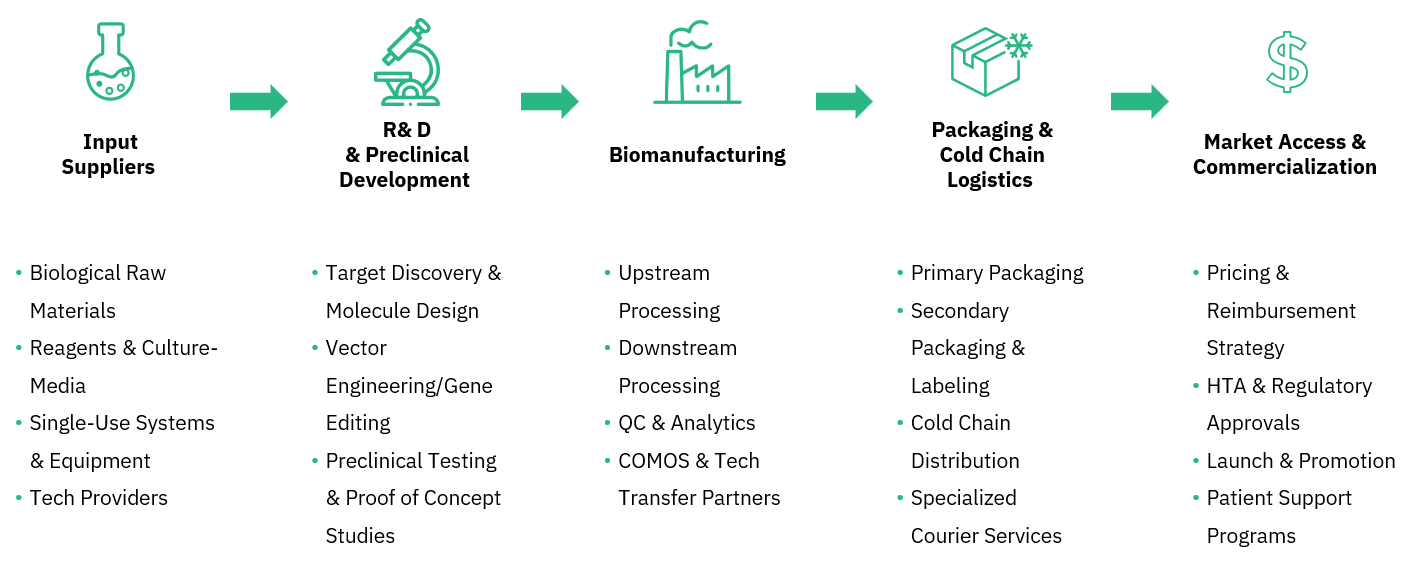

Our offered insights across the biopharmaceutical cluster brings clarity to this complexity, curating forward looking comprehensions across some high impacting categories. From early R&D to commercial launch, we help you decide what’s next, detect whitespace, and act with data-backed solutions in a landscape that evolves by the minute.

_(1).jpg)