Global Monoclonal Antibodies Trials by Year of Registration (2000-2024)

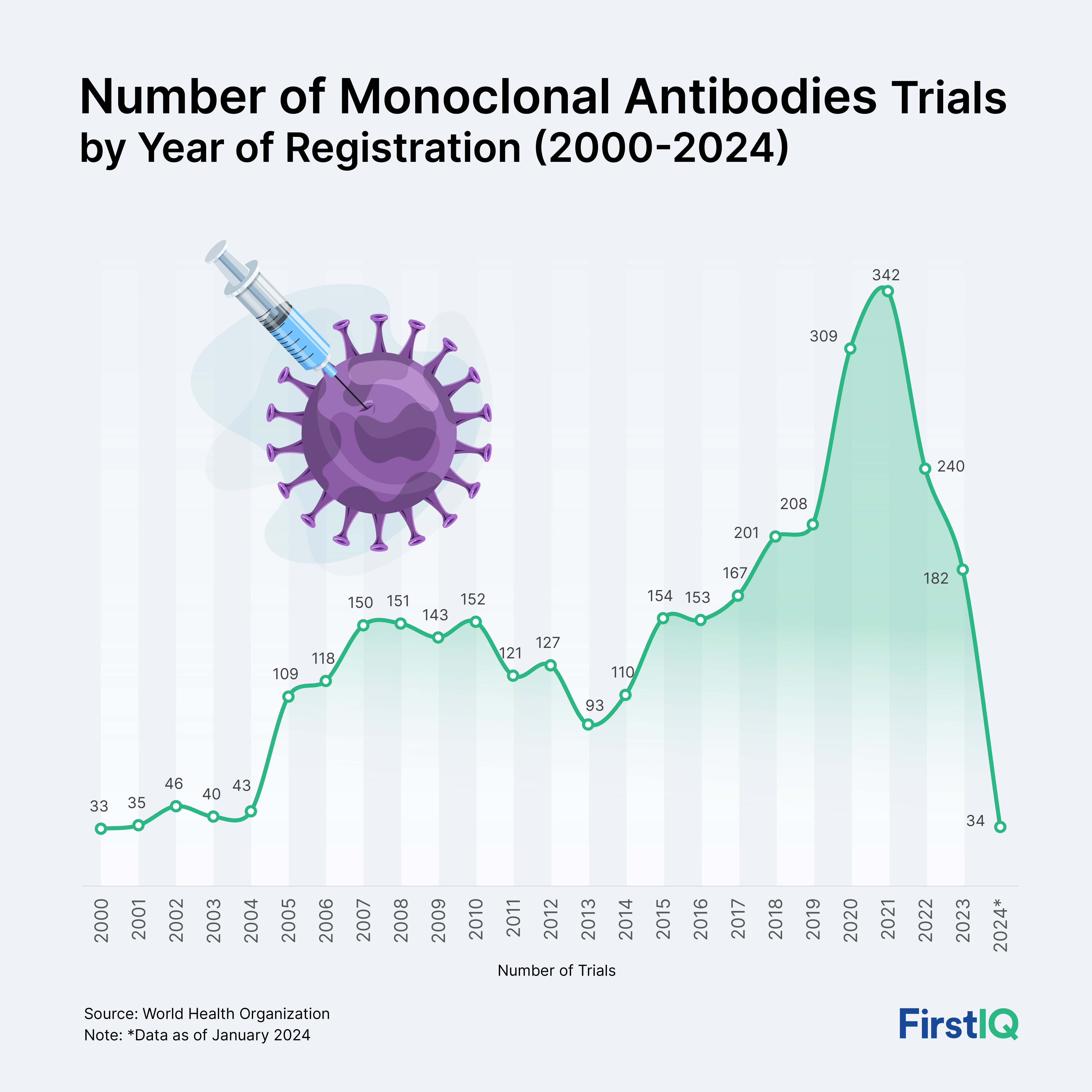

The graph below provides year-on-year registered clinical trials of monoclonal antibodies for all disease indications. The graph highlights a significant increase in clinical trial registration from 2000 to 2023. The year 2021 holds a notable surge in trial registrations, with a total of 342.

Graph: Number of Monoclonal Antibodies Trials by Year of Registration (2000-2024)

Source: World Health Organization

Implications:

1. Growth Rate

- From 33 trials in 2000 to 342 trials in 2021, this reflects a 936% increase over 21 years.

- The annual compound growth rate for registered clinical trials from 2000 to 2021 was 11.8%.

2. Key Trends & Driving Factors Behind the Clinical Trials Growth

- COVID-19 pandemic: The pandemic urgency has led to a time reduction in the clinical trials by 75% leading to increased development of novel mAbs. For instance, companies such as AbCellera, Roche, Astrazeneca, and others have received approval for their COVID-19 mAbs in the U.S. after the start of the pandemic.

COVID-19 mAbs Approved in the U.S. within 10-24 months of Pandemic

|

Monoclonal Antibody |

Sponsor |

Route of Administration |

|

Bamlanivimab & Etesevimab |

AbCellera and Lilly |

IV infusion |

|

Casirivimab & Imdevimab |

Regeneron and Roche |

IV infusion & SC injection |

|

Sotrovimab |

Vir and GlaxoSmithKline |

IV infusion & IM pending |

|

Tixagevimab & Cilgavimab |

AstraZeneca |

IM injection |

- Expanding therapeutic applications: Monoclonal antibodies are now being explored in a wide range of conditions, including infectious diseases, neurological disorders, and cardiovascular diseases.

- Regulatory encouragement: Various regulatory authorities are supporting the development and approvals of monoclonal antibodies. For instance, during the 2014–2023 decade, the WHO observed 84% of trials related to noncommunicable diseases, 11% to communicable and maternal diseases, and 5% to other conditions, including endocrine, blood, and immune disorders.

- Growing biologics demand: The demand for biologics has significantly increased post-pandemic, with 2020 & 2021 observing increased approvals for biopharmaceuticals.

3. Key Stakeholders Conducting These Trials

- Pharmaceutical and Biotech Companies: Companies such as F. Hoffmann-La Roche Ltd., Regeneron Pharmaceuticals Inc., Amgen Inc., Lilly, Bristol Myers Squibb, and Biogen Inc. are the major manufacturers conducting clinical trials.

- Academic and Research Institutions: Organizations such as the Chinese Academy of Sciences & Institute of Military Medical Sciences, National Cancer Institute, and Multiple Myeloma Research Foundation have a large number of mAb trials under sponsorship.

4. Impact on Manufacturers' Strategy and Outlook

- Pipeline Expansion: Companies are investing heavily in R&D with multiple antibody candidates in parallel.

- Platform Diversification: Focus has shifted to bispecific mAbs, ADCs (antibody drug conjugates), and bispecifics. Additionally, various alternatives are being studied to increase the accessibility and efficiency of mAbs. For instance, drug delivery platforms such as Adeno-associated virus delivery platforms, Plasmid DNA-based monoclonal antibody delivery, and nanobodies are under clinical evaluation for mAbs delivery to the targeted site.

- Global Market Reach: Trials are increasingly designed to include global patient pools to gain broader regulatory approval.

- M&A and Licensing Deals: To increase the development of novel mAbs, various biotech firms are undergoing collaborations to use each other's technology platforms and facilitate the development of novel drugs. For instance, in July 2020, UCB collaborated with Roche and Genentech for the development and commercialization of UCB0107 monoclonal antibody to treat Alzheimer’s Disease.

- Cost and access dynamics: With increasing trials, pricing pressure and payer scrutiny will intensify, pushing value-based design.

- Manufacturing capacity expansion: CDMOs and key biotech manufacturers are scaling up mAb development and production capacity globally. For instance, in April 2025, Merck started the construction of a 470,000-square-foot state-of-the-art biologics center in Delaware for the commercial production of KEYTRUDA and other biologics in the U.S.

5. Forecast (2025–2028)

- Trial registrations are expected to stabilize around 200–300 annually post COVID peak years.

- AI-designed antibodies will accelerate the early discovery and reduce the development time.

- Novel formulation, such as a single mAb targeting two disease pathways, will be a major part of clinical trials in oncology and neurological disease areas.

- The global trial network will expand as Asia Pacific is advancing t China, Japan, and India have high potential, and they will run more mAb trials in the coming years.

- There will be a significant rise in biosimilar monoclonal antibodies development as the majority of the mAbs will lose their exclusivity, leading to a growing volume of clinical trials.

Regional Analysis:

Monoclonal antibodies are increasingly investigated in clinical trials; however, most of the trials are being conducted in high-income countries, and very few are conducted in low-income countries.

North America:

- In 2014-2023, most of the clinical trials were carried out in the Americas, accounting for 44% of total trials.

- North America has the highest number of biotech firms, venture capital investments, and regulatory infrastructure, which supports the expansion of mAb programs.

- Company partnerships & collaborations are highly centered in North America for oncology mAbs.

- In January 2025: CARB-X awarded $729,000 to Immunartes to develop a monoclonal antibody for the prevention of Staphylococcus aureus infections.

- In July 2024: Coalition for Epidemic Preparedness Innovations (CEPI), awarded 43.5 million funding to advance the clinical trials of Nipah mAb, MBP1F5 conducted by non-profit biotechnology company ServareGMP and supported by Mapp Biopharmaceutical.

- Advances in genomics and proteomics have led to novel biological targets, leading to increased lead development.

Europe:

- Europe accounts for 48% of the global clinical trials as per the WHO analysis.

- Since 2006, Europe has approved the highest number of biosimilars across the globe.

- In Europe, biopharma companies are highly focused on conducting clinical trials.

- Novartis AG: Ianalumab (VAY736) study in multiple Phase II/III trials as of June 2023 for autoimmune disorders.

- Genentech: Afimkibart’s Phase 3 trials launched in 2024 for ulcerative colitis at European sites.

- Hoffmann-La Roche Ltd: Vamikibart, a humanized anti-IL-6 mAb, is under phase 3 evaluation for the treatment of uveitic and diabetic macular edema with European regulatory orphan designation and multicenter trial sites.

- Robust regulatory framework for all international clinical trials, such as quality module, GMP compliance, first in human trials requirements, has boosted the confidence of investigators in clinical trial results.

Asia Pacific:

- Asia Pacific’s mAb clinical trials landscape is rapidly evolving, with China advancing the clinical research through funding grants and collaborating with global biotech firms.

- China has increased its focus on innovations by improving its regulatory environment for clinical research and new drug approvals.

- In China, most of the companies developing therapeutic antibodies are focusing on cancer. As per the CEO of Innovent Biologics, the number of Chinese companies developing immunotherapies for cancer continues to grow steadily, with Innovent Biologics studying 7 biologic products, including bispecific mAbs and PD-1 based therapies nivolumab and pembrolizumab.

Rest of World:

- Though mAbs clinical trials have expanded in low and middle-income countries, about 66% of all mAb trials registered in 2014-2023 are carried out in high-income countries.

- Globally, only 1% of trials are conducted in low-income countries, showing missed opportunities to conduct clinically relevant research.

- As per the WHO, only 6% trials on mAbs are conducted in Africa, majorly focus on infectious diseases, and very few focus on cancer treatment.

- Factors such as fragmented regulatory system, infrastructure limitations, low funding for research, and drug integrity barriers lead to the decreased number of clinical trials.