Diagnostic Devices Market Intelligence

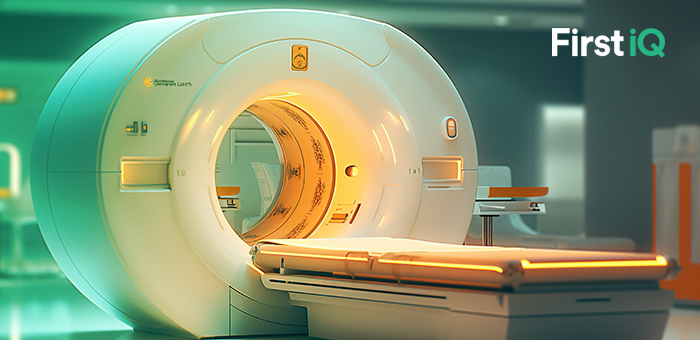

Diagnostics are no longer just a supporting act, they are now driving the future of precision healthcare. From advanced MRI systems unveiling early stage pathologies to rapid POCT bringing critical care to the bedside or the home, and next generation IVD enabling targeted treatments, diagnostic technologies are reshaping clinical pathways.

Global demand for timely, accurate, and affordable diagnostics is being amplified by trends such as:

Rising burden of chronic and infectious diseases

Shift toward decentralized and preventive care

Digital transformation of healthcare systems

AI’s growing role in image based and molecular diagnostics

Push for faster diagnosis to enable faster therapeutic interventions

At the same time, diagnostic markets face pricing pressures, stringent regulations, fragmented value chains, and the urgent need for interoperability.

Where We Add Value: We go beyond standard market sizing, we identify emerging white spaces, track evolving clinical demand, and help our clients anticipate shifts in reimbursement, technology adoption, and purchasing behavior, so they can make faster, smarter market moves. Our insights decode these complexities across the diagnostic devices value chain from product innovation to market adoption helping clients:

- Prioritize investments

- Anticipate regulatory shifts

- Track new revenue streams (POCT, AI driven imaging, at home testing)

- Benchmark their competitive edge in fast evolving markets

.png)

.jpg)

.jpg)