The Fizz Factor: North America Beverage Industry Bubbles up CO2 Demand in 2025

.jpg)

Julia Leferman, Secretary General, The Brewers of Europe said that, “the beer sector is a cornerstone of the European economy, offering contributions that flow through various sectors. The brewing sector creates jobs, value-added and government revenues across Europe.”

As per The Brewers of Europe, EU27 is the second largest beer producing region in the world, after China, even given the fact that, in mid-2023, production costs were 20-25% higher than in 2019. Despite this, there were over 9,600 active breweries in 2023, an increase of almost 50% since 2016. Similarly, the brewery count in North America has shown a surge in the last decade.

U.S. Brewery Count, 2001 - 2024

Source: Brewers Association

The above graph indicates a surge in the U.S. Brewery count from 1545 units in 2000 to 9922 units in 2024. A spike can be observed in brewery count in the last decade from 2011 to 2020, owing to the increasing inclination of consumers towards craft beer. The craft beer industry constitutes 13.3% of the total beer market.

In terms of revenue, in 2024, retail dollar sales of craft increased 3%, to USD 28.8 billion, and now account for 24.7% of the USD 117 billion U.S. beer market. The rise in craft beer sales and consumption justifies the last decade's spike.

A Glance at the Craft Beer Industry

Definitions of terms used:

Regional Brewery: A brewery with an annual beer production of between 15,000 and 6,000,000 barrels.

Brewpub: A restaurant-brewery that sells 25 % or more of its beer on-site and operates significant food services. The beer is brewed primarily for sale in the restaurant and bar, and is often dispensed directly from the brewery’s storage tanks.

Taproom Brewery: A professional brewery that sells 25 % or more of its beer on-site and does not operate significant food services. The beer is brewed primarily for sale in the taproom and is often dispensed directly from the brewery’s storage tanks.

U.S. Craft Brewery Count, by Category, 2001 - 2024

U.S. Craft Brewery Count, by Taprooms, 2019 - 2024

Source: Brewers Association

The U.S. craft beer market is a growing segment within the broader beer industry, characterized by a focus on unique flavors, local production, and a premium experience. In 2024, the market was valued at USD 30.3 billion, with projections to reach USD 57.7 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 3.42% as per the Breweries Association.

The regional breweries and brewpubs have shown exponential growth in the last decade, wherein the brewpubs increased by 236% from 2011 to 2024. Wherein, regional breweries increased by 217% in the last decade. Thus, it is further expected to boost the demand for CO2 in the country.

The rise in taprooms in the U.S. has been on the rise in recent years, becoming a significant factor in the growth and evolution of the U.S. craft beer industry, fueling the demand for CO2. Taprooms offer customers the freshest possible beer, straight from the source, enhancing the flavor and aroma profiles that can diminish during distribution.

Cola-Cola Revenue, 2021 - 2024 (USD Million)

Source: Coca-Cola Company

Coca-Cola is one of the largest beverage producers globally. The company has its carbonated beverages in different segments, from soft drinks to sparkling water. The company relies on local supplies for the supply of carbon dioxide. The company’s increasing net sales indicate its higher production of carbonated beverages, further driving the demand for carbon dioxide.

Implications

- Non-alcoholic beer grew by 9% globally in 2024. It is projected to surpass ale this year and become the second-largest beer category in the world. Millennials and Gen Z are driving the shift, fuelled by moderation trends like the “sober curious” and “damp lifestyle” movements. This will further lead to an increase in the consumption of carbon dioxide.

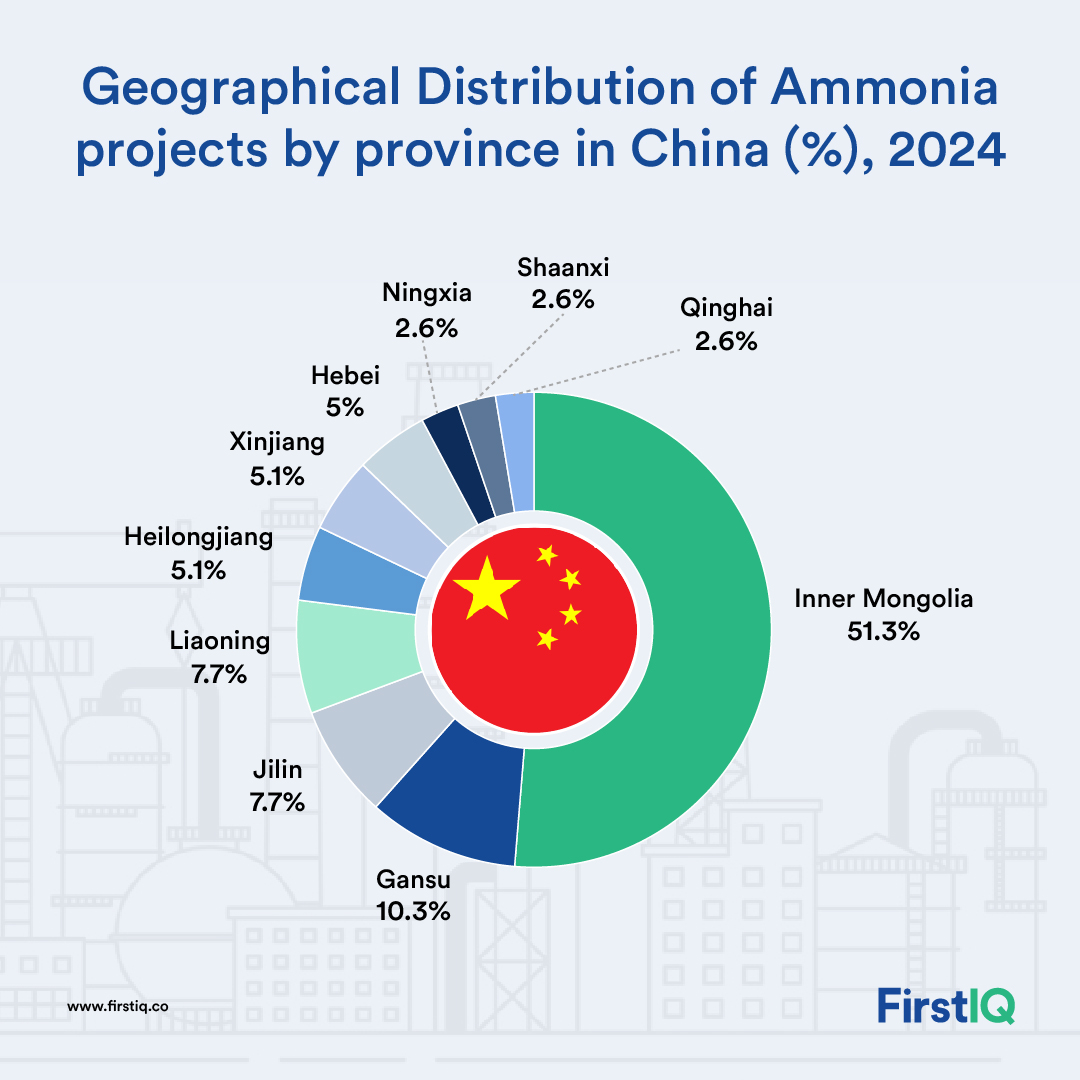

- Increased CO2 production for beverages raises environmental concerns, as CO2 is often derived from industrial processes like ammonia production or fossil fuel combustion. The beverage industry may face pressure to adopt sustainable CO2 sourcing methods, such as carbon capture and storage (CCS) technologies or bio-based CO2 from ethanol production.

- The growing popularity of taprooms and brewpubs, which emphasize fresh, on-site beer, may spur innovations in carbonation processes to optimize CO2 use and reduce waste.