U.S. Ammonia Surge: Competing with Chinese Giants in 2025

- CF Industries – The Dominating Strategy

-

- Tony Will, President and CEO, 2025, "The construction of the ammonia production facility is expected to begin in 2026, with low-carbon ammonia production expected in 2029. The plant will have a nameplate capacity of approximately 1.4 million tons annually and is designed to capture over 95% of CO2 emissions.”

- Woodside Energy’s Eco-Friendly Evolution

- Meg O’Neill, CEO and Managing Director, 2025, “The Beaumont New Ammonia Project, located in Beaumont, Texas, will position Woodside as an early mover in the growing lower carbon ammonia market. The project targets first ammonia production in the second half of 2025 and lower-carbon ammonia in the second half of 2026.”

Global Ammonia Production by Region, 2019-2024 (Kilotons)

Source: International Fertilizer Association

The global ammonia production was estimated at 190.7 million tons in 2024. The U.S. ammonia market is a critical component of the region's industrial and agricultural sectors, driven by its versatile applications across agriculture, textiles, mining, pharmaceuticals, and refrigeration.

U.S. Domestic Ammonia Production, 2019-2024 (Kilotons)

Source: U.S. Geological Survey, Mineral Commodity Summaries

The ammonia production in the U.S. has seen a surge post Covid-19. The production reached 15,694 tons in 2024, with a growth of 23% as compared to 2021. New plant developments and the expansion of capacities of currently operating plants are responsible for the surge in ammonia production in North America. Asia Pacific is, however, anticipated to continue its dominance over the forecast period due to growing foreign investments in the developing economies of China and India.

China Playing Ahead

As per the Ammonia Energy Association, China is the largest ammonia producer and major exporter globally, as it accounts for almost 32% of the global market. Along with largest producer, the country is also a prominent consumer of ammonia, with a consumption of USD 38.33 billion of ammonia, with a CAGR of 4.8% as compared to last year.

China is trying to focus on renewable/green methanol production owing to its increasing demand from Europe and North America. In order to maintain dominance in the market country is trying to increase the production of sustainable ammonia.

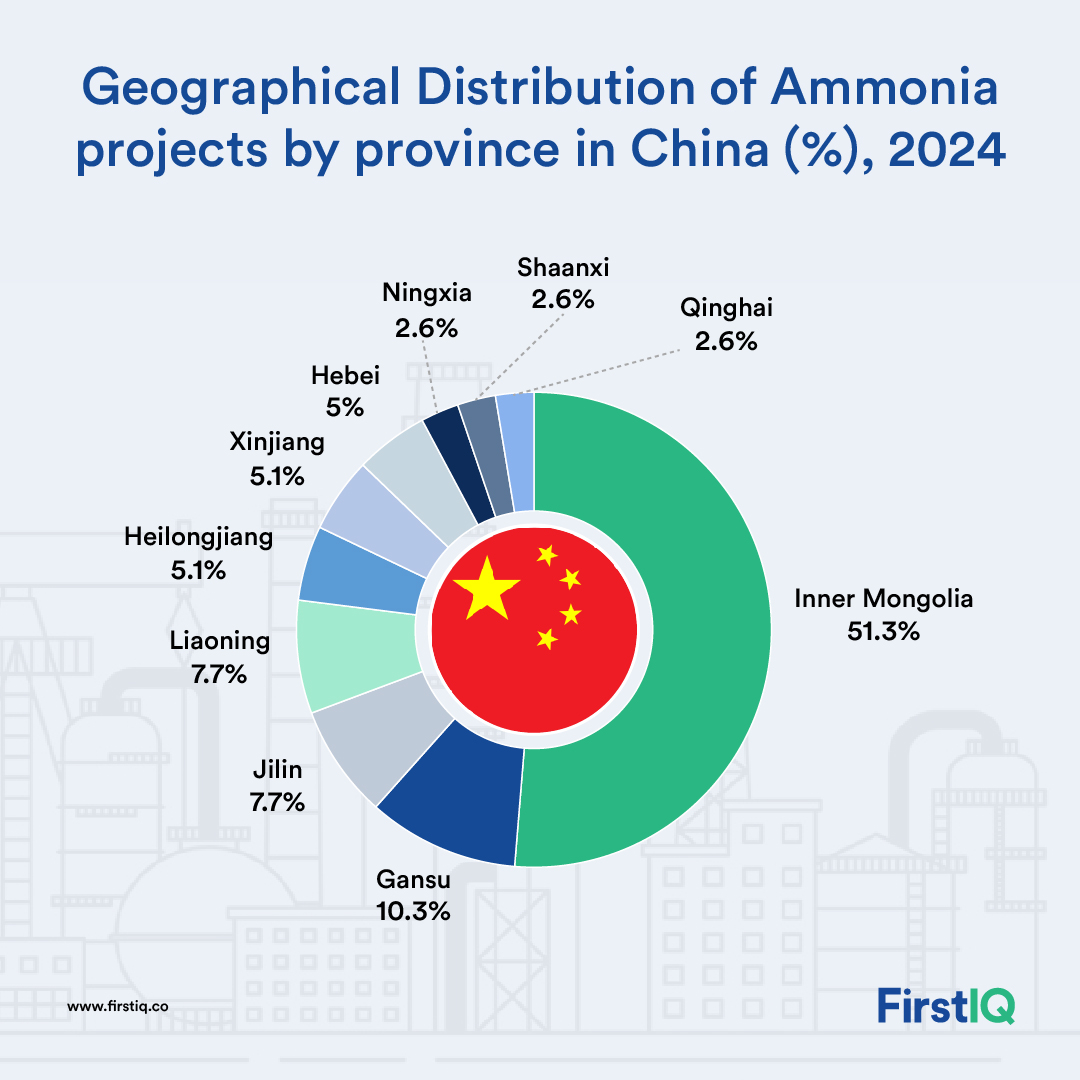

Geographical Distribution of Ammonia projects by province in China (%), 2024

Source: Source- Energy policy

Some of the major green ammonia-producing regions in China include Inner Mongolia, Hebai, Jilin, Liaoning, Gansu, and Heilongjiang, among others.

|

Product Status |

Number of Projects |

Ammonia Production Capacity (Tons/Year) |

|

Operational |

2 |

720,000 |

|

Under Construction |

10 |

2,445,000 |

|

Planned |

28 |

5,948,000 |

|

Total |

40 |

9,113,000 |

Source: Centre on Global Energy Policy at Columbia University SIPA

Currently, there are around 40 ongoing renewable ammonia projects in China in the year 2023-2024 with a production capacity of more than 9 million tons.

U.S. Competes with China Owing to the Presence of Major Producers of Ammonia in the Region.

As of December 24, there were 38 proposed ammonia projects across the U.S., which in the future are projected to increase annual ammonia production capacity by over 60 million metric tons per year by 2030. That would result in a near quadrupling of the amount of ammonia production capacity in the U.S. today.

U.S. Ammonia Plants & Their Production Capacities (Kilotons)

|

Company Name |

Ammonia Plant Location |

Production capacity (Kilotons) |

|

Yara and BASF |

Freeport, Texas |

750 |

|

CF Industries Holdings Inc. |

· Donaldsonville (Louisiana) |

10,505 |

|

Koch Fertilizer, LLC |

· Brandon, Manitoba |

1,190 |

|

OCI Global |

Beaumont, Texas |

80 |

|

Dyno Nobel |

Louisiana, USA |

800 |

Source: Company Annual Report

Implications

The shift from fossil-based (grey) ammonia to blue ammonia will dominate future production. By 2030, green ammonia is expected to account for a significant share of global production, driven by projects like Saudi Arabia’s NEOM facility (1 million tons/year by 2025) and Yara’s Pilbara plant (3,500 tons/year). Blue ammonia production, such as at the Mosaic Faustina facility in the U.S., will also grow, with CCS technologies mitigating emissions.

Innovations in electrolysis, renewable energy integration, and small-scale modular ammonia plants (e.g., Stamicarbon’s technology in Kenya) will enhance production efficiency and accessibility. Electrification of ammonia synthesis, as seen in projects like CF Industries’ Donaldsonville plant, will reduce reliance on natural gas (65.5% of production in 2024).

.jpg)